Hi, I'm Michele Suriano.

I started Castle Rock Investment Company in 2006 because I believe every business deserves the same quality retirement as the big guys.

Now, with Castle Rock PEP, I help businesses of all sizes finally invest in their employees--without the complexity, stress, or jargon associated with being a fiduciary. Check out the Fiduciary Training course if you want to know what we are taking care of for you.

Qualifications and Designations

- FINRA examinations: Series 6, 7, 63, and 66

- Colorado insurance exams for life, health and variable annuities

- Thunderbird's Certificate in Fiduciary Governance

- Tax-Exempt & Governmental Plan Consultant

- Qualified Plan Financial Consultant

- Accredited Investment Fiduciary™

- CFP Registered Paraplanner

- Global Fiduciary Strategist

Awards and Quotes:

-

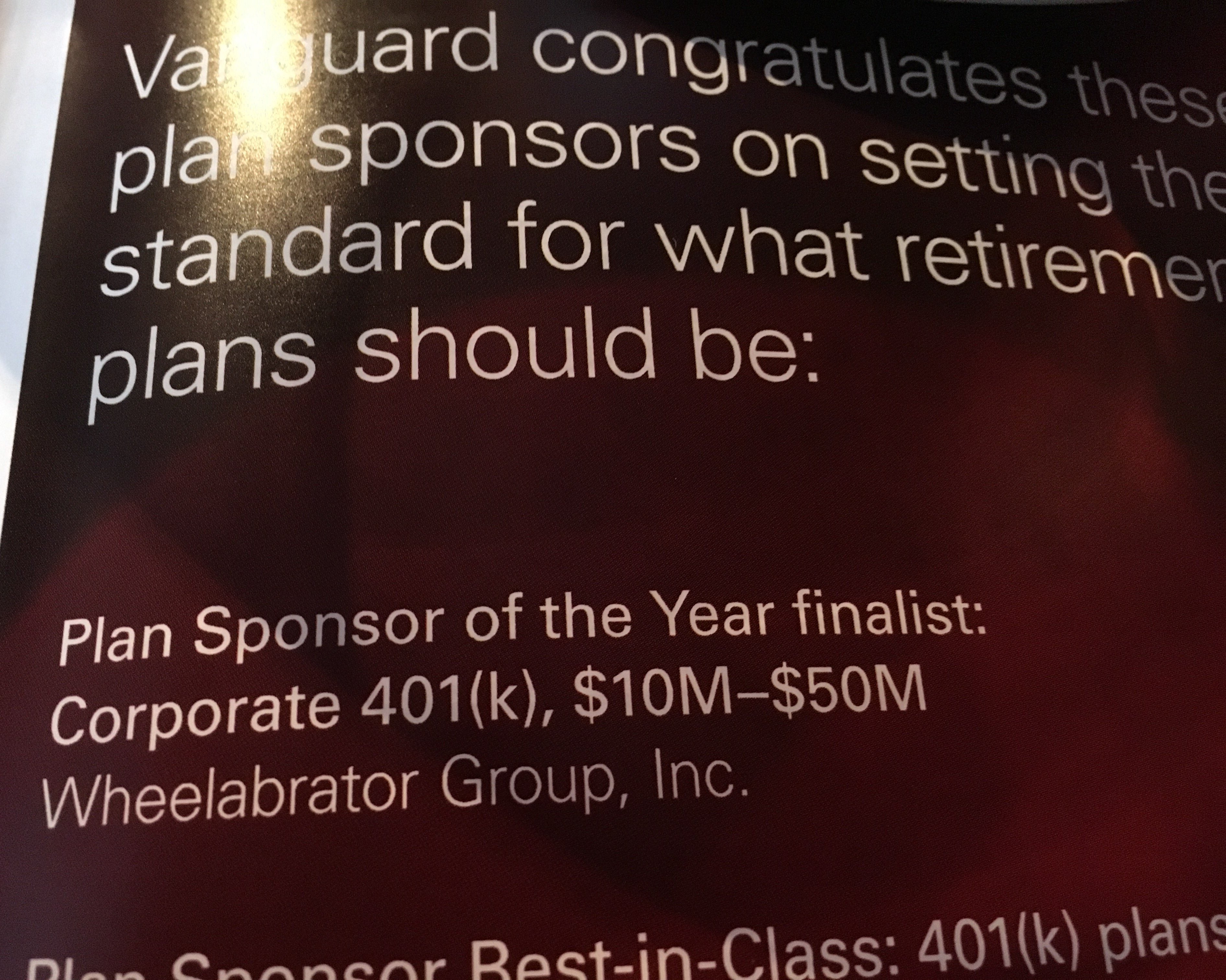

Adviser to two finalists for PLANSPONSOR of the Year

-

Quoted in several industry trade publications

-

Panelist at national conferences

Education

Case study

Read how Castle Rock worked with Wheelabrator Group to improve it's retirement plan outcomes. • Participation Rate – 90% (up from 71%) • Average Deferral Rate – 8.5% (up from 6.6%) • Plan Expenses - Reduced by 34% • Average employee account balance $101,103 • Plan Assets increased 100% to $28.4 million

Download

What current clients wrote on Google

No compensation provided for the testimonials.

"My company (Rocky Mountain Insurance Advisors) has been utilizing the pooled employer retirement plan services of Castle Rock PEP for 6 months now… the experience has been outstanding to date. They have been diligent with regards to helping both launch and administrate the plan for my staff and myself. The plan investment options are numerous, their financial guidance on-the-spot, and the many tax benefits to my family owned and operated business are all needed and welcomed. Michele and Ryan… the plan directors are both top notch professionals that know their craft. I highly recommend Castle Rock PEP's pooled employer plan services to small business owner’s (like myself) that are looking to provide a top-notch, “big-corp type” retirement solution for their employees."

"I’ve had the pleasure of working with Castle Rock Investment Company for the past 8 years, and I couldn’t be happier with their expertise and personalized guidance. The team at Castle Rock is highly professional and knowledgeable. They take the time to understand individual financial goals and tailor their advice accordingly.

Castle Rock provides exceptional customer service, a wide array of investment choices, and well-educated financial guidance. Whether it’s for small or large business needs, Castle Rock covers it all. Castle Rock truly puts clients first. Their consultative approach ensures that each client receives personalized attention and strategic solutions.

Throughout my engagement, Castle Rock maintained clear and transparent communication. They explained complex financial concepts in a way that was easy to understand and easy to manage. The results speak for themselves. Castle Rock manages substantial assets and has a strong track record of success.

Castle Rock Investment Company is a reliable partner for anyone seeking financial guidance. I highly recommend Castle Rock Investment Company's services to any company looking to partner with an independent investment adviser with ERISA expertise."

"Castle Rock helped us select a Pooled Employer Plan as the best course of action for our small organization, and helped us get it up and running quickly. I highly recommend them!"

As Featured In City Lifestyle

Castle Rock Investment Company was featured in April's issue for managing the retirement investments in the pooled employer plan, Castle Rock PEP.

Innovative Match Approach Increases Participation

Read how our client increased employee participation from 67% to 98% and was selected as a finalist for Plan Sponsor of the Year.

Ready for a New Type of Adviser?

Volunteer Work

In addition to her business activities, Michele teaches yoga at https://peaceoutyoga.com.

- Disability Law Colorado ("DLC") Investment Committee (2011 – Present)

- DLC Board of Directors (2011 – 2017)

- Crew Leader, Keepers of the Rock, in partnership with the Town’s Teen Court program (2005 – 2018)

- Western Pension & Benefit Council Board of Directors, Denver Chapter (2007- 2013)

Public Speaking Engagements

- Panelist at the 2010 PLANADVISER National Conference in Orlando, FL

- Panelist at the 2011 PLANSPONSOR National Conference in Chicago, IL, PSNC 2011: Small Plans, Big Challenges, https://www.plansponsor.com/psnc-2011-small-plans-big-challenges/

- Presented at the 2011 Rocky Mountain Area Conference on the importance of measuring retirement readiness and using plan design to optimize participant outcomes.

- Presented at the September 2012, Rocky Mountain Area Conference on the plan-level and participant-level ERISA notice requirements, “408(b)(2) for Responsible Fiduciaries.”

- Panelist at the 2013 PLANSPONSOR National Conference in Chicago, IL PSNC 2013: Metric Taking, https://www.plansponsor.com/psnc-2013-metric-taking/

Quoted in Trade Publications

Quoted in several articles by the retirement benefits industry trade publications, www.plansponsor.com and www.planadviser.com

- The Moment of Truth, The 408(b)(2) fee disclosure rule is a tremendous opportunity for advisers https://www.planadviser.com/magazine/the-moment-of-truth/

- Getting Wired, Seven keys for advisers to use social media effectively. https://www.planadviser.com/magazine/getting-wired/

Adviser to Two Finalists for Plan Sponsor of the Year

Prior Career

- Ceridian (2002-2006) Retirement Plan Adviser, CO

- T. Rowe Price (1999-2002) Investment Adviser, FL

- Transamerica and Advanta (1994 -1999) Executive Branch Manager, CO and VA

Our values

Transparency. Honesty. Trust. Creative Solutions.

This is what you can expect when you work with Castle Rock Investment Company.

We believe

You always come first. You will always know what you are paying for when you trust us with your finances. No hidden fees. No commissions.