Community Page

Investment Options and Performance

Click on the link to see the current investment options and performance.

Investing 101

Curious about what a target date fund means? Want to learn about a glidepath and the distinction between a "to" fund and a "through" fund? Perhaps you're wondering how much you should save and what your target savings rate is according to the National Savings Rate Guidelines. Explore these presentations where I cover all of these topics and provide you with practical advice to help you achieve your retirement goals.

The "How Much Can I Save?" Cheat Sheet

Whether you’re looking ahead to 2026 or using your "tax time machine" to grab last-minute 2025 savings, we’ve got the numbers you need.

- Download: Annual Contribution Limits for 2025 & 2026 – Keep this handy for your next meeting with your CPA!

- Sole Proprietors: Grab Your $1,500 IRS "Thank You" – Did you know you can still defer for 2025? If you're a one-person show or a married duo, you might be eligible for a $1,500 credit just for starting a plan. No employees required.

The Financial Tool Belt

Because everyone has different priorities, and the right tool makes all the difference. Let’s tackle what’s top of mind for you today.

Credit & Savings Basics:

- Track Your Spending: Use the budgeting tool in our RightCapital software to see where your money actually goes.

- Emergency Fund: Start from exactly where you are today. No judgment—just a plan.

- The "Deep Freeze": If you aren’t applying for a loan soon, freeze your credit for protection. It’s free and smart. (Experian | Equifax | TransUnion)

- Going Back to School: Learn the basics of investing with Morningstar's free Investing Classroom.

- What is Your Target Savings Rate for Retirement? Check out Table 2 in The National Savings Rate Guidelines for Individuals

- "We developed these savings guidelines with the hope they will be publicized, generally accepted, and that once people are aware of how much they should save they will better prepare for retirement." Dr. Ibbotson

- Lost a prior 401(k) plan? Check out the the Department of Labor's Lost and Found Database.

College Planning:

- The Essentials: A guide from J.P. Morgan on the current rules and tools.

- The Estimators: Figure out the cost of college and your financial aid need before you get the first tuition bill.

Income Protection (Disability Insurance):

- What it is: A "backup paycheck" if you can’t work due to illness or injury.

- Why it matters: Most of us depend on our monthly income to keep the lights on. Let’s make sure you’re covered.

- Download the Discussion Form and use this free calculator to see your gap.

The Gift of Certainty (Estate Planning)

Remember that Barbie moment? "Do you guys ever think about dying?" We do—but only so your loved ones don't have to worry about the logistics when the time comes.

- Disaster & Emergency Highlights: The must-haves for your "In Case of Emergency" file.

- The Basics (For Free!): Draft a Free Will or a Healthcare Power of Attorney.

- Keep it Out of Probate: Don't let the state decide. Set up a Beneficiary Deed for your home or a TOD for your vehicle.

- Michele’s Personal Wishes: Sometimes it helps to see a real example. Click here to see how I planned my final chapter (including my "surfing in Sayulita" backup plan!).

- If You are the Survivor- We have got your back. Please download our Survivor's Checklist and let us help.

Designing Your Second Act

Retirement isn't an end—it’s a new beginning. Let’s make sure it’s a masterpiece.

- Imagine Your Ideal Day: If money weren't a concern, how would you spend your time? Where would you live?

- How long might you live?

- The Money Bridge: Compare your budget to your Social Security benefit. That "gap" is what your retirement savings are for!

- Income Solutions®: A lifetime income annuity marketplace with simple, streamlined tools that can help you turn your savings into a paycheck for life.

- Legacy Lifeprint: Use this workbook to share your values, hopes, and memories with the next generation. It’s the ultimate love letter.

- Watch & Learn: How do I create monthly income? | What is your target savings rate?

Schedule a One-on-One Meeting

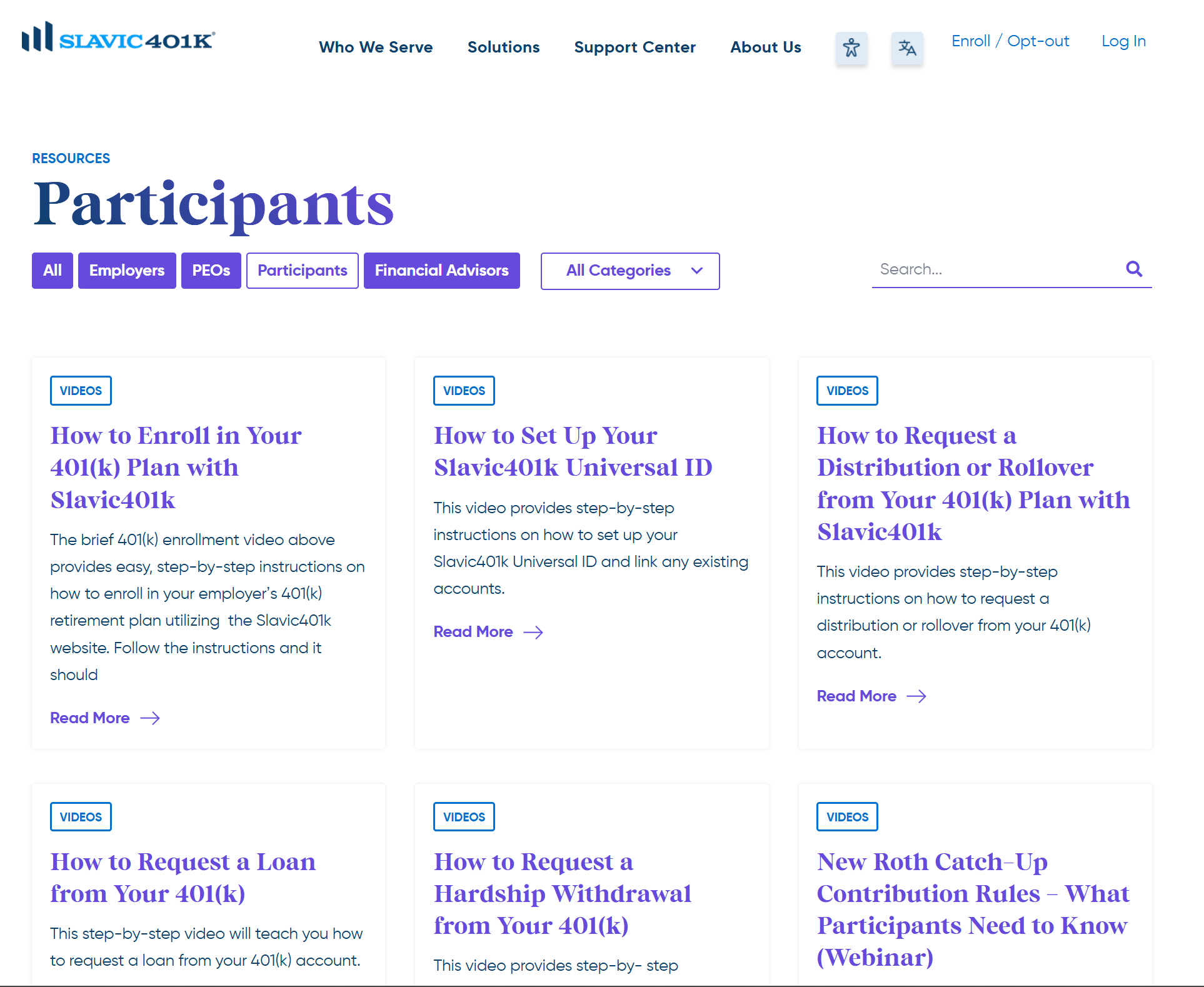

Check Out these Videos

Slavic401k Created for You

Learn:

- How to Enroll

- How to take out a loan

- How to assess Retirement Readiness

- And Much more...

Business Spotlight

Rocky Mountain Insurance Advisors

Watch our full interview (or a clip) with the owner, Bob Willig, on how he works to earn your trust.

A suite of tools at your disposal

Complimentary Financial Planning Software

Create your own personal account with Castle Rock's link here.

Your Future Self will

Thank You

Does your future self seem like a stranger? Are you willing to make sacrifices for your future self today? Can you imagine what your older self may feel one day? Let's close that gap and take a glimpse of ourselves at 70. Dare to share is coming soon...

Visit Castle Rock and Make The Climb