Working Together for You

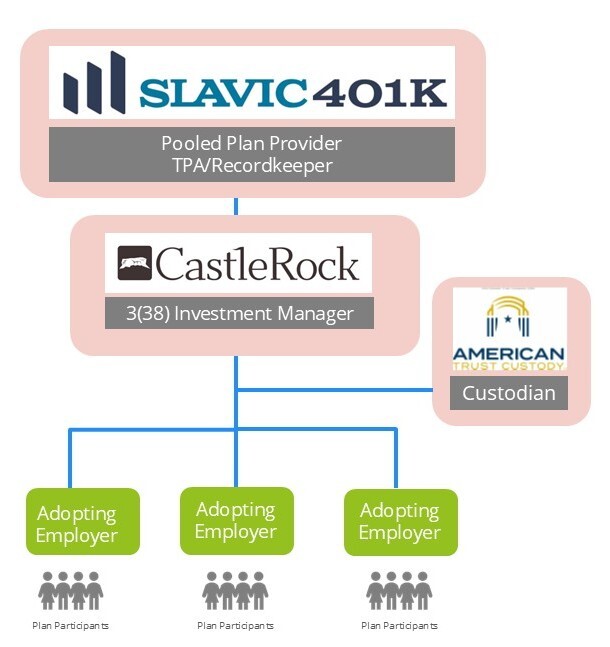

Castle Rock PEP is offered in partnership with Slavic401k. Together, we have created a retirement plan that levels the playing field between enterprise and small business.

The Countdown

For existing plans to outsource for 2026

Watch this 1 minute video overview about merging existing plans into Castle Rock PEP.

Plan Administration

Plan Sponsor

Outsourced

In most retirement plans, the employer typically holds the plan sponsor role, which carries all the administrative, fiduciary and investment duties. Why not outsource it and move most administrative duties off your plate?

Imagine If...

We pooled together

Castle Rock PEP was designed with every size employer in mind. By pooling together with other employers, costs are lowered by negotiating services and fees on the collective behalf. This is a win-win for employers AND employees.

| Castle Rock Investment Company | Slavic401k | Adopting Employer | |

|---|---|---|---|

| Select and monitor service providers: PPP, 3(38), trustee, other service providers as designated by the PPP | |||

| Select and monitor plan investment options | |||

| Select PEP plan provisions applicable to all adopting employers | |||

| Select plan provisions applicable to adopting employer | |||

| Review and approve plan provisions applicable to adopting employer | |||

| Prepare, review and approve plan amendments | |||

| Sign plan adoption agreements | |||

| Provide complete employee census data | |||

| Submit plan contributions or utilize Payroll Integrations | |||

| Provide updates to change in company ownership or restructuring | |||

| Monitor plan IRS contribution limits | |||

| Monitor timely submission of contributions | |||

| Prepare and deliver participant regulatory disclosures | |||

| Approve and process participant loans and distributions | |||

| Prepare, sign and submit IRS/DOL Form 5500 | |||

| Perform, review and approve plan testing | |||

| Make necessary plan corrections to keep plan compliant |

Case study

This case study highlights the impact an innovative match approach had on employee participation.

Download

Guide

An overview of Castle Rock PEP including investment performance, benefits, contacts, and pricing.

Download

Course

This is part one of a two part ERISA fiduciary training course for committee members

Download

Fiduciary Training Quiz

This multiple choice quiz is based on part one of the Fiduciary Training course.

Take the Quiz

Capabilities Statement

An updated outline of the capabilities of Castle Rock Investment Company

Download

Webinar

"How much should I save?" It's the first question during a one-on-one meeting. This video reviews the National Savings Rate Guidelines and answers the question.

Download