Part 3 of 3: The S-Corp Tax Survival Guide You thought March 16, 2026 was the end of the line for...

Pooled Employer Plan vs. State Mandated IRA

| Trait | Castle Rock PEP | State IRA |

|

Investment Options |

Professionally Managed |

Government Selected |

|

Employer Match |

Employer Option |

None! |

|

2024 Employee Contribution Limits |

$23,000 |

$7,000 |

|

Pretax and Roth Contributions |

Both Pretax and Roth |

Roth |

|

Annual Limit Employee + Employer |

$69,000 |

$7,000 |

|

Age 50+ Catch-up Contribution |

$7,500 |

$1,000 |

|

Employer Contribution Tax Credits |

None! |

|

|

Plan Costs as Business Deductions |

Your Choice |

None! |

Enjoy SECURE 2.0 Tax Credits

The tax credits below are available to companies with 50 or fewer employees and no prior retirement savings plan.

-

$500 for three years

To add automatic enrollment plan provision.

-

$250 for startup costs in first three years

Per eligible non-highly compensated employee up to $5,000 each year.

-

$1,000 per employee

For employer contribution to participants earning up to $100,000. Gradually reduces over five years. See IRS Form 8881.

Avoid state mandated retirement plans and fines

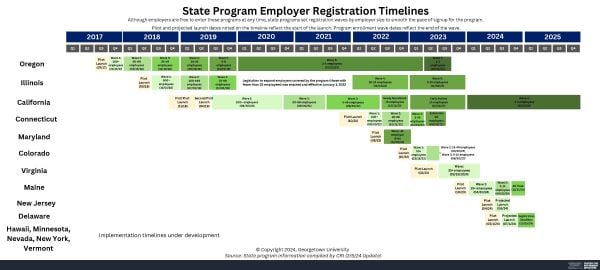

As of January 2024, 10 of the 19 state programs (8 auto-IRA – CA, CO, CT, IL, MD, ME, OR, and VA) and 2 others – MA (MEP) and WA (Marketplace) are open to all eligible employers and workers. Source: https://cri.georgetown.edu/states/

Did you receive a letter from your state?

PEP Benefits

Just a few of the benefits of pooled employer plans...

-

Scalable for micro plans

-

Individual plan design

-

Reduced fiduciary risk

-

Zero audit fee

-

Outsource trustee role

-

One Form 5500

Welcome back to the S-Corp Tax Survival Guide. In Part 1, we dropped the time machine bombshell:...