A Smart, Shared Retirement Plan for Your Business

Because Even the Boss Deserves to Retire

""Castle Rock helped us select a Pooled Employer Plan as the best course of action for our small organization, and helped us get it up and running quickly. I highly recommend them!"

Phil Triolo, CPA, CFP®

President & CFO Matthew Twenty Five LLC

“I’ve had the pleasure of working with Castle Rock Investment Company for the past 8 years, and I couldn’t be happier with their expertise and personalized guidance. The team at Castle Rock is highly professional and knowledgeable. They take the time to understand individual financial goals and tailor their advice accordingly.

Castle Rock provides exceptional customer service, a wide array of investment choices, and well-educated financial guidance. Whether it’s for small or large business needs, Castle Rock covers it all. Castle Rock truly puts clients first. Their consultative approach ensures that each client receives personalized attention and strategic solutions. Throughout my engagement, Castle Rock maintained clear and transparent communication. They explained complex financial concepts in a way that was easy to understand and easy to manage.

The results speak for themselves. Castle Rock manages substantial assets and has a strong track record of success. Castle Rock Investment Company is a reliable partner for anyone seeking financial guidance. I highly recommend Castle Rock Investment Company's services to any company looking to partner with an independent investment adviser with ERISA expertise.”

Jeff Day

Senior Manager Shippers Automotive Group, LLC

“My company (Rocky Mountain Insurance Advisors) has been utilizing the pooled employer retirement plan services of Castle Rock PEP for 6 months now… the experience has been outstanding to date. They have been diligent with regards to helping both launch and administrate the plan for my staff and myself. The plan investment options are numerous, their financial guidance on-the-spot, and the many tax benefits to my family owned and operated business are all needed and welcomed. Michele and Ryan… the plan directors are both top notch professionals that know their craft. I highly recommend Castle Rock PEP's pooled employer plan services to small business owner’s (like myself) that are looking to provide a top-notch, “big-corp type” retirement solution for their employees.”

Bob Willig

Founder / Owner Rocky Mountain Insurance Advisors

63%

17

$100

Choose one of our three most popular safe harbor plan designs.

All three plans automatically enroll employees after three months of service with a 3% savings rate that increases 1% each year up to 10%. Employees can opt out at any time.

The Employer chooses the contribution amount:

-

3% contribution to everyone with immediate vesting

-

3.5% to savers as a match with up to two years vesting

- 100% Match on first 1%, 50% Match on next 5%

- Employee saves 6%, then Employer contributes 3.5%

-

4% to savers as a match with immediate vesting

- 100% Match on first 4%

- Employee saves 4%, then Employer contributes 4%

Did you pick one of the three plan designs above?

Get Started Today in just 10 Minutes

☝️Jot down this passcode: CRP401k

You will want to have on hand:

- Company EIN/Tax ID

- Company owner(s) names and their ownership percentage

- The names and job titles of all employees who are lineal relatives of an owner

- The names and job titles of all highly compensated employees

- Names and job titles of all company officers

Second Quarter 2025 Review

Enjoy SECURE 2.0 Tax Credits

The tax credits below are available to companies with 50 or fewer employees and no prior retirement savings plan.

-

$500 for three years

To add automatic enrollment plan provision.

-

$250 for startup costs in first three years

Per eligible non-highly compensated employee up to $5,000 each year.

-

$1,000 per employee

For employer contribution to participants earning up to $100,000. Gradually reduces over five years. See IRS Form 8881.

Looking for a tax credit?

Form 8881 Credit Estimator (Small Employer Pension Plan)

Part I — Credit for Small Employer Pension Plan Startup Costs

Part II — Small Employer Auto-Enrollment Credit

Part III — Military Spouse Participation Credit

Estimated Credit Summary

Email me my estimate & next steps

-

Sign Up Online

Fast, hassle-free enrollment.

-

Select Your Plan Design

Choose your custom plan design.

-

Employees Enroll & Start Saving

Simple onboarding for your team.

-

Ongoing Compliance & Management

We handle the hard part so you don't have to.

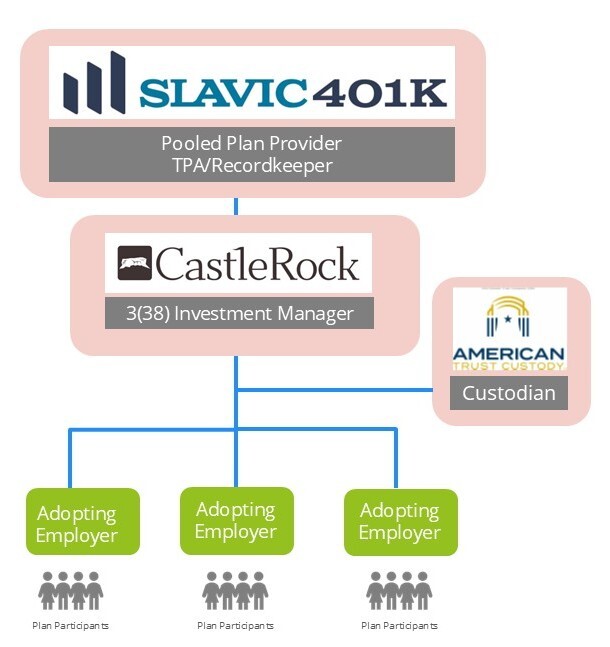

Why a Pooled Employer Plan?

-

Lower Adminisrative Costs - Save money by joining a pooled plan with multiple employers.

-

Reduced Fiduciary Liability - We handle compliance and administration so you can focus on growing your business.

-

Simplified Compliance & Reporting - No need to worry about IRS and DOL filings - we've got it covered.

-

Professional Investment Management - Expert oversight to help your employees build wealth securely.

-

Access to Tax Credits - Small businesses may qualify for up to $5,000 in tax incentives.

Frequently Asked Questions

-

What is a Pooled Emloyer Plan (PEP)?

A PEP is a retirement savings plan that allows multiple businesses to participate in a single, professionally managed 401(k) plan - reducing costs and administrative burdens.

-

How does a PEP reduce my fiduciary risk?

We assume much of the fiduciary responsibility, ensuring compliance with IRS and DOL regulations.

-

Who is eligible to join a PEP?

Any business, regardless of size, can join a PEP to provide employees with retirement savings.

As Featured In City Lifestyle

Castle Rock Investment Company was featured in April's issue for managing the retirement investments in the pooled employer plan.