You know that iconic Barbie moment where everything is sunshine and small talk… and then she drops:...

Emergency Planning: Protecting Yourself and Your Loved Ones When the Unexpected Happens

Picture this: You're getting ready for your morning routine, stepping out of the shower, when suddenly your foot slips on the wet tile. In an instant, you're down, and the world goes black. When you come to, you're lying on your bathroom floor, disoriented and alone. Or maybe you're driving home from work on a Tuesday evening when another driver runs a red light. The next thing you know, you're waking up in a hospital bed with concerned faces surrounding you.

These scenarios aren't meant to frighten you: they're reminders that life can change in an instant. But here's the beautiful truth: with just a few simple steps, you can ensure that even in these unexpected moments, you and your loved ones are protected and prepared.

The Power of Being Prepared

At Castle Rock Investment Company, we've spent years helping businesses and employees build financial security through our pooled employer plan (PEP) and retirement plan solutions. But financial wellness extends far beyond your 401(k) contributions and investment choices. True peace of mind comes from knowing that all aspects of your life are thoughtfully organized: including what happens when you can't speak for yourself.

Michele Suriano, our founder, often reminds clients that planning isn't about expecting the worst; it's about creating the best possible outcomes when life throws us curveballs. Just as we help small businesses establish low cost 401(k) plans that protect their employees' futures, emergency planning protects your immediate well-being and that of your family.

Your Phone: The Ultimate Emergency Companion

Let's start with something you carry everywhere: your smartphone. In that bathroom slip scenario, imagine if paramedics arrived and could instantly access your medical information, emergency contacts, and critical health details. Most people don't realize that both iPhone and Android devices have built-in emergency features that can be lifesavers.

Setting Up Medical ID on Your Phone

For iPhone users: Go to the Health app, tap "Medical ID," and fill in your essential information: blood type, allergies, medications, emergency contacts, and any medical conditions. This information can be accessed from your lock screen during an emergency.

For Android users: Open Settings, search for "Emergency Information," and complete your profile with the same critical details.

Include information about:

- Your primary care physician

- Current medications and dosages

- Allergies and medical conditions

- Emergency contact numbers

- Your preferred hospital

- Any advance directives you've completed

This simple 10-minute task could quite literally save your life. When you're unconscious and can't communicate, your phone becomes your voice.

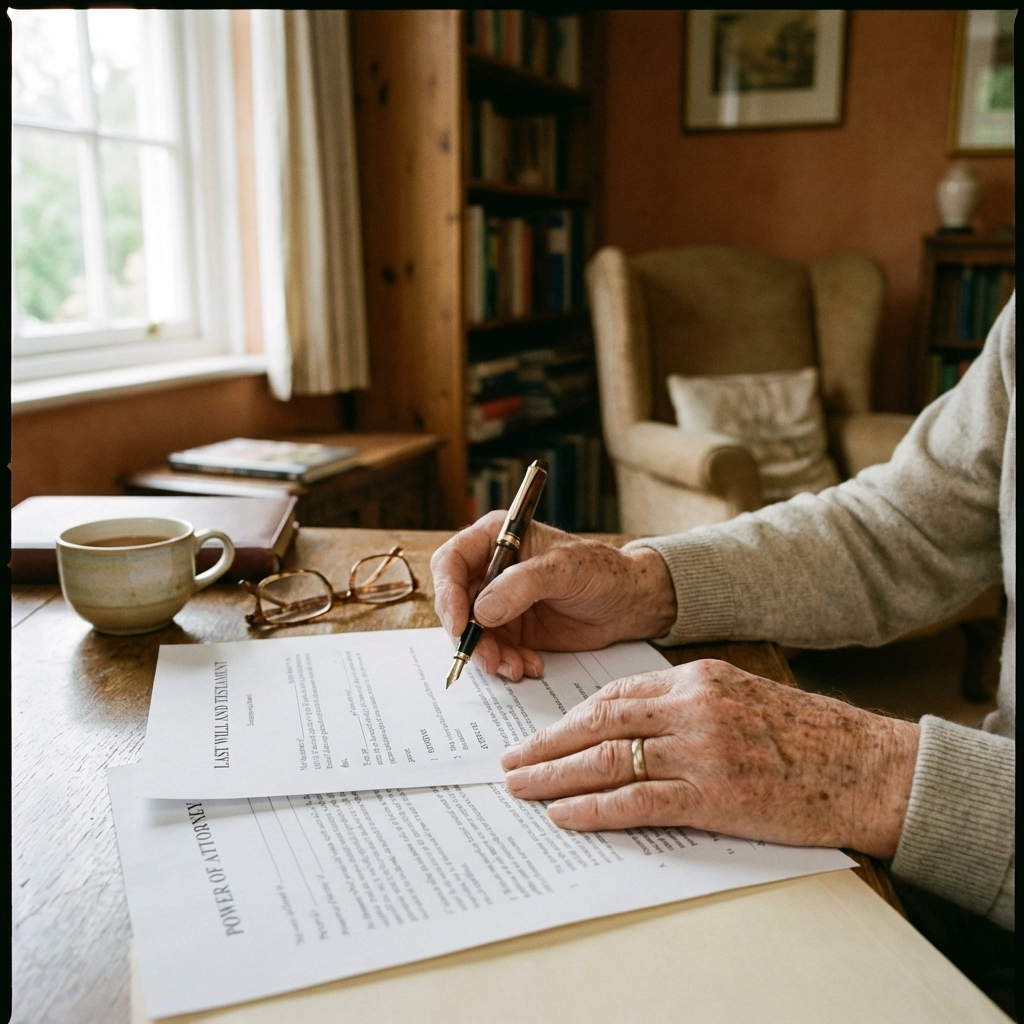

Beyond the Basics: Advance Directives and the Five Wishes

While emergency medical information handles immediate care, advance directives ensure your longer-term wishes are honored. Think of them as the financial wellness equivalent for your healthcare: they're plans that protect your values and preferences when you can't express them yourself.

Medical Orders for Scope of Treatment (MOST)

A MOST form is a bright pink document that provides specific medical instructions for people with serious illnesses or frailty. Unlike traditional advance directives, MOST forms are medical orders signed by a physician and are immediately actionable by emergency responders.

If you have chronic health conditions or are over 65, consider discussing a MOST form with your doctor. It's particularly valuable because it travels with you and provides clear guidance to any healthcare provider about your treatment preferences.

The Five Wishes: Your Complete Life Plan

Perhaps the most comprehensive and user-friendly advance directive tool is called "Five Wishes." This document goes beyond medical decisions to address your emotional, spiritual, and relational needs. The five wishes cover:

- Who you want to make healthcare decisions for you when you can't

- The kind of medical treatment you want or don't want

- How comfortable you want to be

- How you want people to treat you

- What you want your loved ones to know

What makes Five Wishes special is its human approach. Instead of cold legal language, it uses warm, conversational terms that help your family understand not just what you want, but why you want it. It's legally valid in 42 states and creates a bridge between you and your loved ones during difficult times.

Connecting Emergency Planning to Financial Wellness

At Castle Rock, we understand that true financial wellness encompasses more than retirement savings, though our PEP solutions and 401(k) plans remain foundational to your future security. Emergency planning protects the wealth you're building and ensures your financial decisions align with your healthcare wishes.

Consider this: if you're incapacitated without proper documentation, your family might face expensive legal proceedings to make decisions on your behalf. Court-appointed guardianships can cost thousands of dollars and take weeks to establish: time your loved ones could spend focusing on your recovery instead of navigating legal complexities.

Just as we help small business owners streamline their retirement plan administration through our pooled employer plan, proper emergency planning streamlines decision-making during medical crises.

Building Your Emergency Plan: A Step-by-Step Approach

Creating an emergency plan doesn't have to be overwhelming. Here's how to tackle it:

Week 1: Digital Setup

- Update your phone's emergency medical information

- Ensure your emergency contacts have current phone numbers

- Take photos of important documents and store them in cloud storage

- Share your phone's passcode with one trusted person

Week 2: Documentation

- Schedule a conversation with your primary care physician about advance directives

- Download and review the Five Wishes document

- Consider whether a MOST form is appropriate for your situation

- Gather information about your current medications and health conditions

Week 3: Family Conversations

- Discuss your wishes with close family members or friends

- Share the location of your important documents

- Ensure your chosen healthcare proxy understands your values and preferences

- Consider scheduling a family meeting to discuss everyone's plans

Week 4: Professional Review

- Have an attorney review your advance directive documents

- Update beneficiaries on your retirement plan and other accounts

- Ensure your emergency contacts are listed with your employer and financial institutions

- Store copies of documents in multiple safe locations

The Ripple Effect of Preparedness

Emergency planning creates a ripple effect of security that extends far beyond individual safety. When employees know they and their families are protected, they're more focused and productive at work. This is why forward-thinking employers who partner with Castle Rock for their small business retirement plan often encourage emergency preparedness as part of their overall financial wellness initiatives.

Your advance directives work hand-in-hand with the retirement security you're building through your 401(k). Both represent investments in your future self: one protecting your wealth, the other protecting your values and wishes.

Making It Real: Sarah's Story

Sarah, a 45-year-old marketing manager whose company participates in Castle Rock's pooled employer plan, learned the value of preparation firsthand. After completing her Five Wishes document and updating her phone's medical ID, she felt more confident about her overall financial wellness strategy.

Six months later, Sarah was in a skiing accident that left her unconscious for several hours. Because paramedics could access her medical information immediately, they knew about her medication allergies and contacted her emergency contacts right away. Her completed advance directives meant her family could focus on her recovery rather than guessing about her treatment preferences.

Sarah's story isn't unique: it's a reminder that preparation transforms crisis into manageable challenges.

Taking Action: Your Next Steps

Emergency planning isn't about pessimism; it's about love. It's about loving yourself enough to make your wishes clear and loving your family enough to spare them from difficult guessing games during stressful times.

Start small. Update your phone's medical ID today. Download the Five Wishes document this week. Schedule a conversation with your doctor next month. These simple steps create layers of protection that work together to safeguard your well-being.

Just as Castle Rock simplifies retirement planning for businesses of all sizes, emergency planning simplifies crisis response for families of all configurations. Whether you're single, married, have children, or care for aging parents, having a clear plan benefits everyone in your circle.

At Castle Rock Investment Company, we believe that comprehensive financial wellness includes preparing for life's unexpected moments. While we help you build wealth for tomorrow through our retirement plan solutions, we also encourage you to protect the life you're living today.

Your future self: and your loved ones: will thank you for taking these simple but profound steps toward preparedness. After all, the best emergency plan is the one you hope you'll never need, but feel grateful to have.

Ready to enhance your overall financial wellness strategy? Connect with the Castle Rock team to learn how our comprehensive approach supports both your retirement security and your peace of mind.