If you’re a CFO/CEO/COO/C--, you know that every line item comes with risk. When it comes to your...

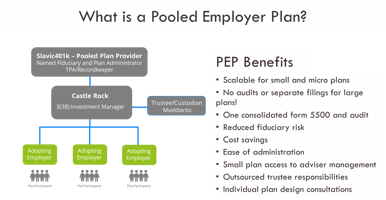

What is a Pooled Employer Plan?

A Pooled Employer Plan (PEP) is a 401(k) solution designed to bring together companies of all sizes—whether small businesses or larger organizations—into one unified plan, while still allowing each employer to create a retirement strategy that feels just right for their team. Unlike a Multiple Employer Plan (MEP), PEPs don’t require a shared “nexus,” which means more businesses can participate and offer meaningful retirement support to their employees.

This flexibility opens doors for employers who may have previously found it challenging or even impossible to offer their teams a competitive retirement plan. Now, without the complexity of multiple administrative layers or the restrictions of needing a common business connection, a broader range of employers can support their employees’ future financial security.

Participating in a PEP can also lead to significant cost savings. By pooling resources with other businesses, employers may benefit from economies of scale—potentially lowering plan fees and improving investment options. Additionally, the professional oversight provided by the pooled plan provider helps ensure the plan stays compliant with changing regulations, giving employers peace of mind and more time to focus on running their businesses.

What makes the PEP approach truly special is how it cultivates a sense of shared financial well-being. It eases the administrative burden for employers, making it easier for everyone to help their teams build a more secure future—together.

Ultimately, a PEP empowers employers to make a heartfelt investment in their employees’ futures. By joining a community committed to retirement readiness, businesses not only attract and retain great talent but also make a positive, lasting impact on the lives of their teams.