Do you live in an auto-IRA program state? As of June 30, 2024, 17 states established auto-IRA...

Colorado Compliance Trap: How FAMLI Data Sharing Just Changed the Game

If you're a Colorado employer, 2026 just became the year where "flying under the radar" officially died.

While most business owners were busy dealing with the usual January chaos, tax prep, budget planning, and those New Year's resolutions to finally organize the filing cabinet, the Colorado Department of Treasury quietly pulled off something that should make every employer in the state sit up and pay attention.

They connected the dots. Literally.

The Data Sharing Agreement You Didn't Know About (AKA: The End of the Data Quality Loophole)

Buried in the December 2025 Colorado SecureSavings Board materials was a single line that changes everything:

"New Employer Data: Paid Family Leave Data - executed data sharing agreement."

Translation? The folks running Colorado SecureSavings (the state-mandated retirement program) and the FAMLI (Family and Medical Leave Insurance) program are now playing on the same team. They're sharing data. Your data.

And per the Board notes, this isn’t just a “nice-to-have link.” It’s the state’s way of ending what we’ll politely call the Data Quality Loophole: the reality that old employer lists were messy, outdated, and full of wrong contacts.

In fact, the state admitted to “limited employer engagement” in the first 2025 wave (about 16,000 employers) specifically because of data quality issues. In plain English: they tried to reach employers using old lists… and a lot of those lists were not exactly winning “most accurate spreadsheet of the year.”

Here’s what “we cleaned up the list” looks like when you translate it into actual numbers from the December 2, 2025 Board Meeting:

- They removed ~33,000 bad employer records during the clean-up.

- They updated 8,000 existing records with fresh emails and mailing addresses.

- The total employer pool dropped from 110,760 to 74,068 because they finally scrubbed the bad data.

Want the receipts / a peek behind the curtain? Here are the December 2025 Board Materials so you can see the enforcement strategy and data clean-up plan in the state’s own words:

December 2025 Colorado SecureSavings Board Materials (source)

One more “insider” stat that’s easy to miss: as of late 2025, over 41,000 employers have already filed for exemptions (which usually means they already offer their own plan), while only about 17,500 employers are actually registered for the state program. Translation: the state knows a lot of employers are handling this with their own plan… and they also know there’s a big group that still needs to be chased down.

If you're registered with FAMLI, and unless you went through the nightmare of opting out, you probably are, the state now has a direct pipeline to your:

- Employee headcount

- Payroll information

- Business structure

- Contact details

More importantly (and this is straight out of the Board’s direction of travel), that FAMLI feed is being used to clean out bad records and update employer contact information with newer, better data. So if your plan was “they probably have the wrong email for us”… congrats, that plan is getting deleted and replaced with your current info.

And if you're not registered with Colorado SecureSavings? That red flag just got a whole lot brighter.

What is FAMLI, Anyway?

For those who've managed to avoid this particular bureaucratic maze, FAMLI is Colorado's paid family and medical leave insurance program. It launched in 2023, and by 2024, nearly every Colorado employer with at least one employee was automatically enrolled unless they jumped through hoops to opt out.

The program requires employers to:

- Pay premiums (0.88% of wages as of 2026, down slightly from 0.9%)

- Handle payroll deductions

- Navigate a state portal that makes the DMV look user-friendly

- Stay compliant with ever-changing notice requirements

And here's the kicker: the same state agency managing FAMLI is now the enforcement arm for Colorado SecureSavings compliance.

The "No More Hiding" Reality

Let's connect the dots here.

Colorado SecureSavings requires businesses with 5 or more employees that have been in operation for at least two years to either:

- Offer a qualified retirement plan (like a 401(k)), or

- Facilitate the state's auto-IRA program

Before this data sharing agreement, enforcement was… let's say "theoretical." Businesses could register (or not), and the state didn't have a great way to cross-reference who was actually in scope.

Not anymore.

Now, if your business is in the FAMLI system, which it almost certainly is, the Colorado Department of Treasury already knows:

- How many employees you have

- How long you've been in business

- Whether you're registered for SecureSavings

The enforcement mechanism isn't coming. It's here. And it's automated.

The Personal Cost of "Doing It Yourself"

Here's where theory meets reality, and it's not pretty.

Let's talk about what it actually takes to navigate these state-run systems. Take FAMLI, for example. One Colorado business owner applied to opt out in December 2024. The application was finally approved in February 2026, over a year later.

In that time:

- Countless hours spent on hold with the state

- Multiple submissions of the same documentation

- Payroll deductions that kept happening anyway

- A credit balance of -$349.88 (yes, the state owes them money)

- Zero clarity on when or how that credit would be returned

And that's just for FAMLI. Now imagine dealing with two interconnected state programs, each with its own portal, its own deadlines, and its own bureaucratic black hole of customer service.

The math is simple: every hour you spend navigating state portals is an hour you're not running your business. And if you get it wrong? The penalties stack up fast.

The Fine Print (Literally)

Colorado SecureSavings isn't playing around when it comes to enforcement. While the state has been relatively quiet about publicizing the specific penalty structure: some might say they've "washed" the internet of those details: the reality for non-compliant employers is clear:

$100 per eligible employee, per year.

For a business with 10 employees, that's potentially $1,000 annually in fines. For a business with 50 employees? $5,000. And that's assuming first-time non-compliance. Repeat offenders face even steeper consequences.

But here's what keeps business owners up at night: it's not just the fine itself. It's the cascade of administrative nightmares that follow:

- Notices of non-compliance

- Formal audits

- Required documentation proving why you weren't compliant

- Potential back-penalties if the state determines you should have registered earlier

And with the FAMLI data-sharing agreement in place, the state doesn't need to manually hunt for non-compliant businesses. The system flags them automatically.

Why 2026 is Different

2025 was the "grace period" year: when the state sent warning letters and educational materials. Employers could register late without major consequences.

But 2025 also came with a quiet asterisk: the state’s own Board materials point out limited employer engagement in the first 2025 annual wave (around 16,000 employers) because their outreach lists had data quality problems. That was the loophole. Not a legal loophole—an “our list is a mess” loophole.

Now they’re closing it.

2026 is the enforcement year.

The Colorado Department of Treasury has spent the last two years building out its infrastructure, hiring auditors, and: as we now know: connecting data systems. They have the tools. They have the information. And they have the mandate to start collecting.

And here’s the part that should make you update your compliance plan today, not “sometime this quarter”: the Board notes also reference a “Second Annual Wave”—and this is exactly how they catch the employers who slipped through the first time.

Per the December 2, 2025 notes, that Second Annual Wave targeted 6,300 new employers with a November 15th deadline. In other words: once the list got cleaned (and contact info got upgraded), the state ran another pass to scoop up anyone who wasn’t reached—or wasn’t reachable—during Wave 1.

So if you slipped past the first round because your contact info was stale, the Second Wave is basically the state saying: “No worries—we brought a better list… and a deadline.”

The "I didn't know" defense? It stopped working on January 1, 2026.

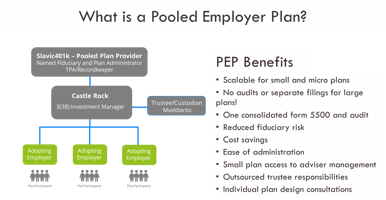

The Castle Rock PEP Solution: Your Get-Out-of-Bureaucracy Card

Here's the good news: you don't have to choose between paying state fines and drowning in administrative paperwork.

A qualified 401(k) plan: specifically, a Pooled Employer Plan (PEP) like Castle Rock PEP: satisfies the Colorado SecureSavings requirement entirely. You register once with the state to confirm you have a plan, and you're done. No facilitation of the state program. No ongoing state portal navigation. No automated enforcement flags.

Even better? The administrative burden shifts entirely off your plate:

What Castle Rock PEP Handles:

- All plan administration and compliance

- ERISA 3(16) fiduciary responsibility

- Employee education and enrollment

- Investment monitoring and selection

- Annual testing and reporting

- State registration confirmation

What You Handle:

- Payroll deductions (which you're probably already doing for FAMLI anyway)

- Welcoming your team to better benefits

And unlike the state's auto-IRA program, a 401(k) through a PEP offers:

- Higher contribution limits ($24,500 in 2026 vs. the IRA limit of $7,000)

- Employer matching opportunities (which the state program doesn't allow)

- Tax credits for small businesses that can offset much of the cost

- Roth and traditional options for employee flexibility

No 14-month approval processes. No mysterious credit balances. Just a straightforward, compliant solution that actually benefits your team.

The Compliance Crossroads

Colorado employers are standing at a crossroads in 2026. You can:

- Ignore it and hope the enforcement letters don't land in your mailbox (spoiler: they will)

- Facilitate the state program and accept that you'll be managing yet another administrative burden alongside FAMLI

- Offer a qualified plan and gain a recruiting advantage while checking the compliance box

The third option is the only one that turns a state mandate into a business advantage.

What Happens Next?

If you're reading this and realizing you haven't registered for Colorado SecureSavings: or worse, you're registered for FAMLI but not offering any retirement benefit: the clock is already ticking.

The state won't send you a courtesy reminder before the fines start. The data sharing agreement means they already know who you are and whether you're compliant.

Your next steps:

- Check your status: Are you registered with Colorado SecureSavings? Do you have 5+ employees and have been in business for 2+ years?

- Evaluate your options: Can you afford to keep navigating state portals, or would a qualified plan serve your business better?

- Talk to someone who handles this daily: Contact Castle Rock PEP for a straightforward conversation about what compliance actually looks like in 2026: and how much easier it can be than fighting with state systems.

The Bottom Line

The Colorado compliance landscape just got a whole lot more real. With the FAMLI data-sharing agreement in place, the state has turned enforcement from a manual process into an automated one. They have your data. They have the penalties ready. And they have no reason not to use both.

You can spend the next year fighting state portals and hoping for the best, or you can solve the problem once with a solution that actually benefits your team.

Castle Rock PEP: Simplifying retirement for all. One plan. Every business.

Ready to skip the state bureaucracy and protect your business? Start today or schedule a PEP Talk to learn how we make Colorado compliance the easy part.